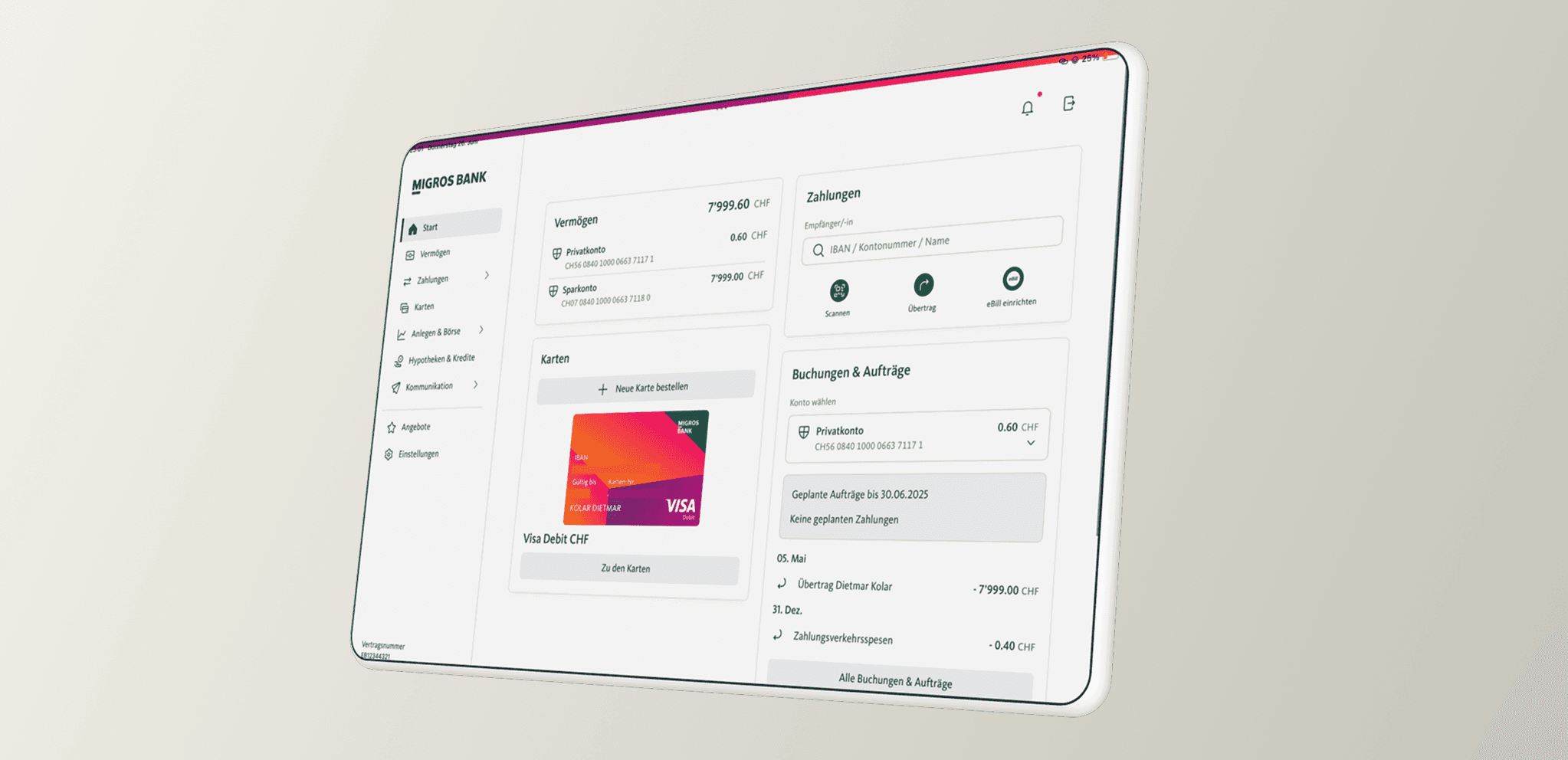

One Electronic Banking for SMEs — Making Business Finance Work

How Migros Bank is transforming complex financial workflows into intuitive digital tools, designed with real users in mind.

Role

UX Designer at Mimacom

Industry

Finance / Digital Banking

Duration

13 months

Understanding the Business Context

The Business Engineers in our team explored the workflows of Swiss SMEs — from payroll to mortgage overviews. Based on stakeholder input and user feedback, we prioritized features that provide direct value and reduce friction in everyday banking tasks.

Key user challenges we tackled:

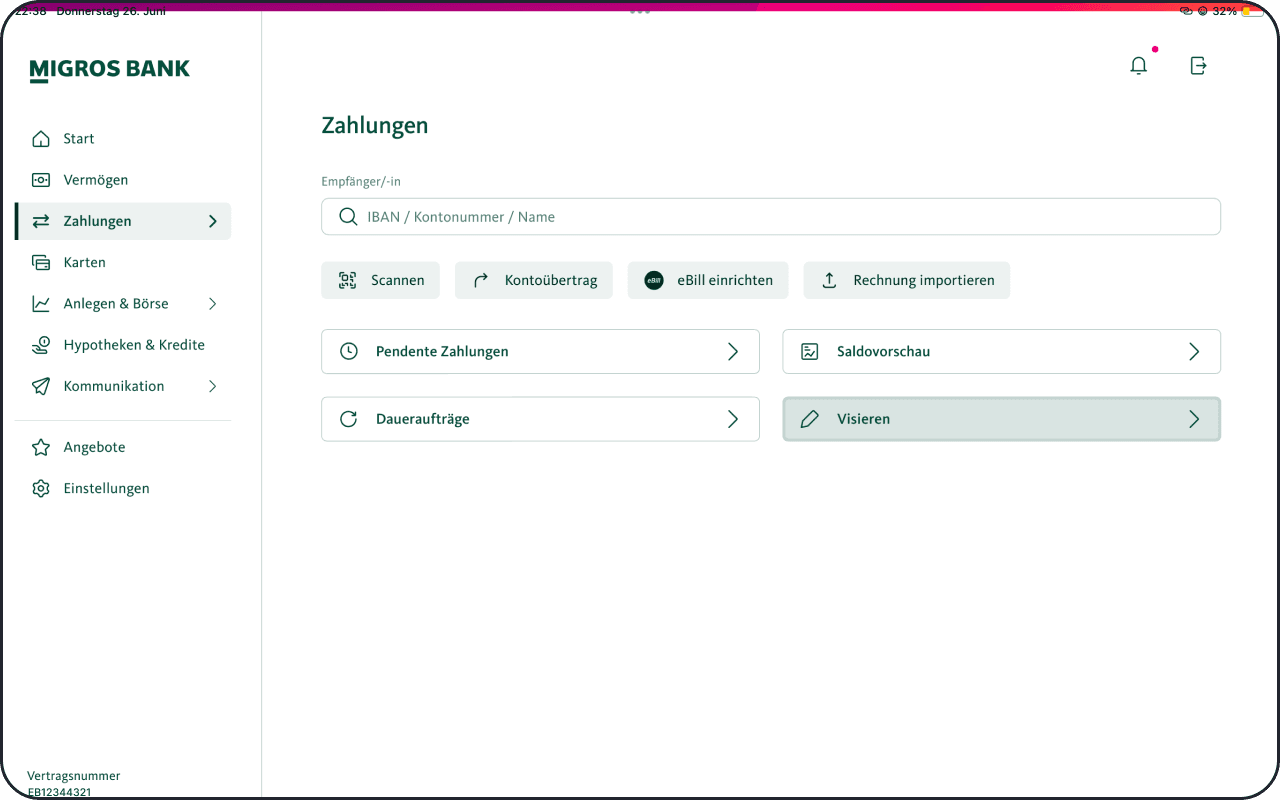

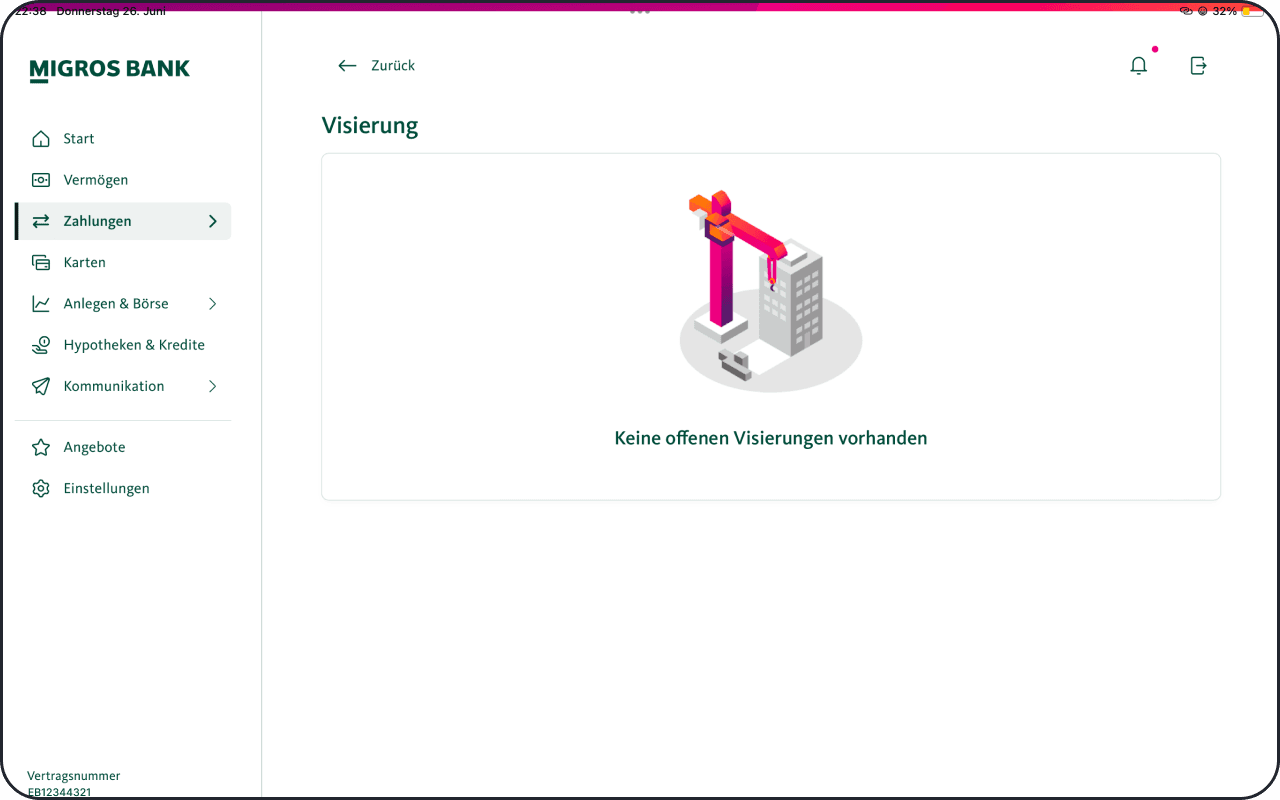

Approving payment orders with multiple internal stakeholders

Uploading payment files (e.g., for salary runs)

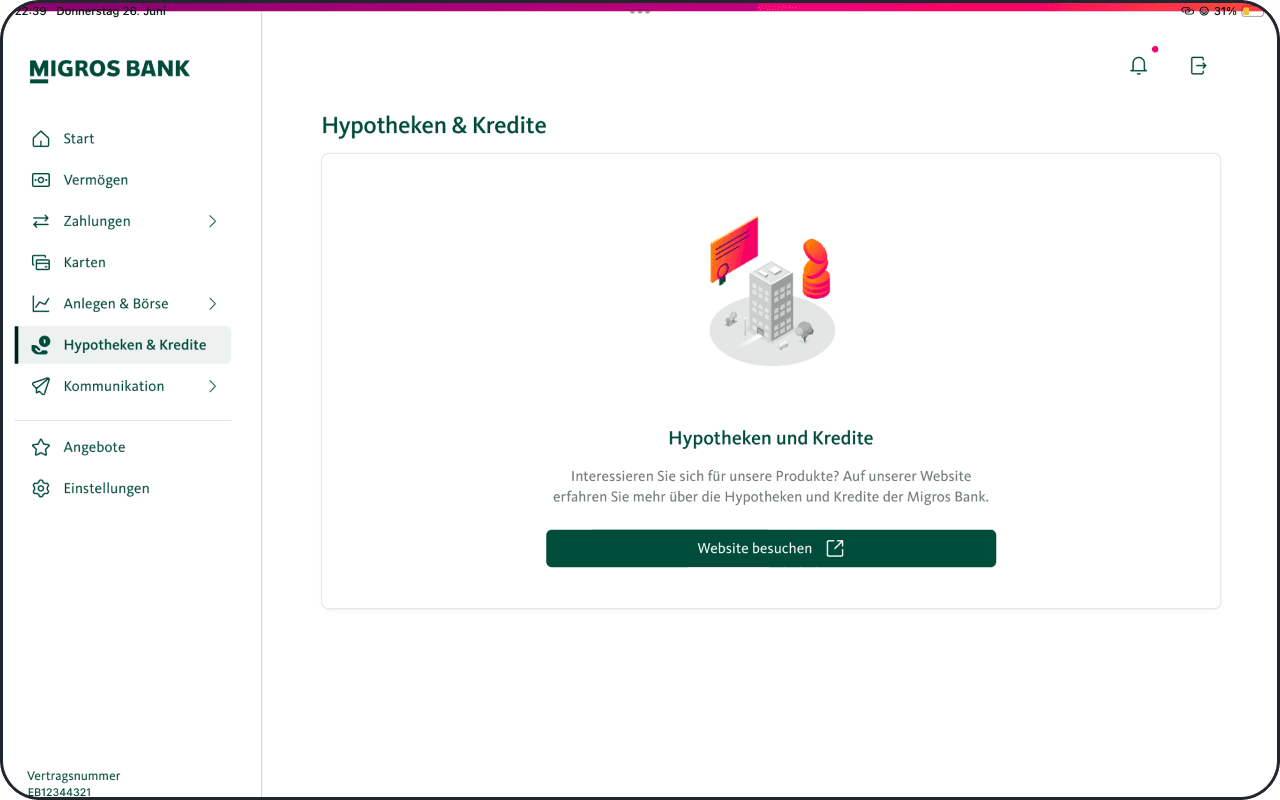

Providing an intuitive future entry point for managing mortgages

Design Process

Our UX process was tightly integrated with the agile development rhythm. I collaborated closely with product owners, analysts, and developers, working in sprints and using Figma as our shared language for prototypes and specifications.